Aktio (aktio.xyz) Broker Review

Aktio presents itself as an international brokerage firm offering access to CFD trading across forex, cryptocurrencies, indices, commodities, and equities. The company promotes professional support, advanced technology, and regulatory oversight. However, a detailed review of its corporate disclosures, regulatory claims, platform transparency, and client feedback reveals serious inconsistencies that cannot be ignored.

This article provides a strict analytical examination of Aktio based on available public data, domain information, company statements, and user complaints.

Company Overview

Aktio lists its address as 3 de Febrero 1901, Rosario, Santa Fe, Argentina, and provides a support phone number and email. Beyond these details, the broker discloses almost nothing about its corporate structure.

There is no publicly available information confirming:

- the legal name of the operating entity

- company registration number

- ownership structure

- executive team

- parent organization

For a financial company handling client funds, this level of anonymity represents a significant risk.

The broker claims to have been operating since 2017. However, domain data suggests that the aktio.xyz website appeared later, and there is no credible digital footprint supporting long-term operations. There are no reliable media mentions, industry references, or historical records demonstrating that Aktio has maintained continuous brokerage activity.

This discrepancy immediately raises concerns about the company’s credibility.

Regulation

Aktio claims to be regulated by several major financial authorities, including:

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Dubai Financial Services Authority (DFSA)

- International Financial Services Commission (IFSC)

Checks of official regulatory registers do not confirm the existence of a licensed broker named Aktio or any authorization connected to the aktio.xyz domain.

The broker does not publish license numbers, regulatory certificates, or direct links to regulator databases. Without verifiable proof, these claims should be treated as misleading rather than reassuring.

Operating without confirmed regulation means:

- client funds are not protected

- no regulatory supervision exists

- dispute resolution mechanisms are absent

- compensation schemes do not apply

This alone places Aktio in the high-risk category.

Websites and Domains

Aktio primarily operates through the aktio.xyz domain and has also been associated with ak-tio.world.

The use of multiple domains is frequently observed among questionable brokers, particularly when companies attempt to distance themselves from negative feedback or operational restrictions.

Additional concerns include:

- domain history inconsistent with the claimed founding year

- lack of a long-term archived presence

- minimal public exposure

- no meaningful social media footprint

A broker claiming international reach would normally maintain a visible and traceable online presence.

Trading Platform

Aktio does not provide access to widely recognized platforms such as MetaTrader 4 or MetaTrader 5. Instead, clients are directed to a proprietary trading system.

The problem is not the existence of a proprietary platform, but the absence of transparency.

The broker does not disclose:

- execution model (STP, ECN, or dealing desk)

- liquidity providers

- price aggregation methods

- external audits

- trade routing

Without independent verification, clients cannot determine whether trades are executed in real markets or internally simulated.

This gives the broker full control over pricing and execution.

Trading Accounts

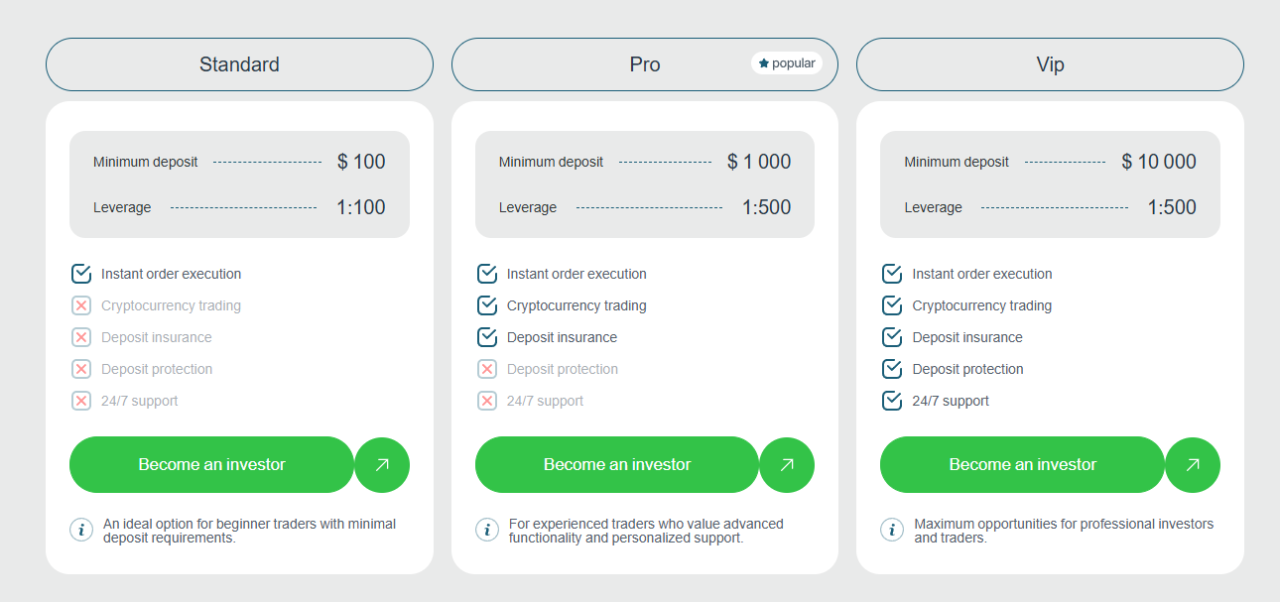

Aktio advertises several account tiers requiring minimum deposits ranging from $1,000 to $50,000.

Promoted features include:

- personal account managers

- PAMM-style accounts

- instant execution

- swap-free trading

- investment protection

- customized service

These statements are presented in promotional language without detailed contractual backing.

Claims related to capital protection or insurance are particularly concerning because the broker does not identify any insurer, compensation fund, or legal framework supporting such protection.

Trading Conditions

The broker advertises leverage of up to 1:100 but does not provide critical details such as spreads, commissions, margin requirements, or liquidation rules.

Aktio also promotes investment programs offering returns of up to 3.5% over periods ranging from one month to three years.

Missing information includes:

- how returns are generated

- where client funds are held

- risk exposure

- legal guarantees

Offering leveraged trading alongside stable return products is inherently contradictory and often associated with high-risk or fraudulent schemes.

Deposits and Withdrawals

Aktio states that it accepts funding through bank cards, wire transfers, electronic wallets, and cryptocurrencies. However, withdrawal terms are largely undisclosed.

The broker does not clearly specify:

- minimum withdrawal amounts

- processing timelines

- applicable fees

- compliance procedures

User complaints describe a recurring pattern. After requesting withdrawals, clients are allegedly instructed to pay additional charges labeled as taxes, insurance, or account unlocking fees. Even after complying, funds are reportedly not released.

Such practices deviate sharply from legitimate brokerage standards and are commonly associated with financial fraud.

Legal Documentation and KYC

Although Aktio claims to follow KYC and AML procedures, transparent legal documentation is either missing or incomplete.

The client agreement does not clearly define:

- governing law

- dispute resolution mechanisms

- liability structure

- withdrawal rights

When legal terms are vague or inaccessible, clients effectively operate without protection.

User Complaints

Available feedback about Aktio is overwhelmingly negative. Clients frequently report:

- inability to withdraw funds

- aggressive communication from account managers

- pressure to deposit additional money

- account restrictions after refusing further payments

- sudden loss of contact with the company

No verified track record of long-term satisfied clients has been identified. The repetition of similar complaints suggests a systemic operational pattern rather than isolated incidents.

Key Risk Indicators

The investigation highlights multiple structural warning signs:

- absence of verified regulatory authorization

- anonymous corporate structure

- conflicting operational timeline

- non-transparent trading platform

- high minimum deposits

- hidden withdrawal conditions

- repeated client complaints

- marketing claims unsupported by documentation

This combination of factors is rarely seen in legitimate brokerage firms.

Final Verdict

Aktio (aktio.xyz) demonstrates a concentration of risk factors consistent with unregulated and potentially fraudulent brokerage operations. Its regulatory claims cannot be verified, corporate transparency is lacking, and user reports consistently describe financial losses and withdrawal obstacles.

The broker does not appear reliable. Engaging with Aktio carries a substantial risk of losing invested funds.

Investors are strongly advised to avoid transferring money or providing personal documents to this platform. Those who have already interacted with the broker should consider contacting their payment provider and seeking professional assistance as soon as possible.