Apexairtek Broker Review

Apexairtek is presented as an online trading company operating through the domains apexairtek.com and apexa-irtek.vip. The broker claims to offer access to global markets, advanced trading technology, and professional client support. At first glance, the website resembles a modern financial platform. However, a deeper inspection reveals significant risks and inconsistencies that investors should be aware of.

Company Background

Company Information

Apexairtek provides no verified legal details about its ownership, registration, or jurisdiction. The website contains general statements about global presence but offers no real documentation. The advertised office locations in major cities cannot be confirmed through official registries.

History and Credibility

The broker claims to have years of experience, but domain records show that the website is recent. There are no historical traces of the company in financial directories or corporate databases.

Regulation

Licensing Status

Apexairtek is not licensed by any legitimate financial authority. Searches through major regulatory bodies show no registration under the company’s name:

- No FCA license

- No ASIC license

- No CySEC license

- No DFSA approval

- No offshore regulatory listing

Regulatory Warnings

The Central Bank of Russia has already flagged Apexairtek for operating with signs of illegal financial activity. This is a major warning signal indicating potential fraud.

Trading Platform

Platform Overview

Apexairtek advertises a proprietary trading platform. However:

- The platform is not certified

- No technical documentation is available

- No independent audits exist

- Interface behavior reported by clients suggests a simulated environment rather than real execution

User Interface

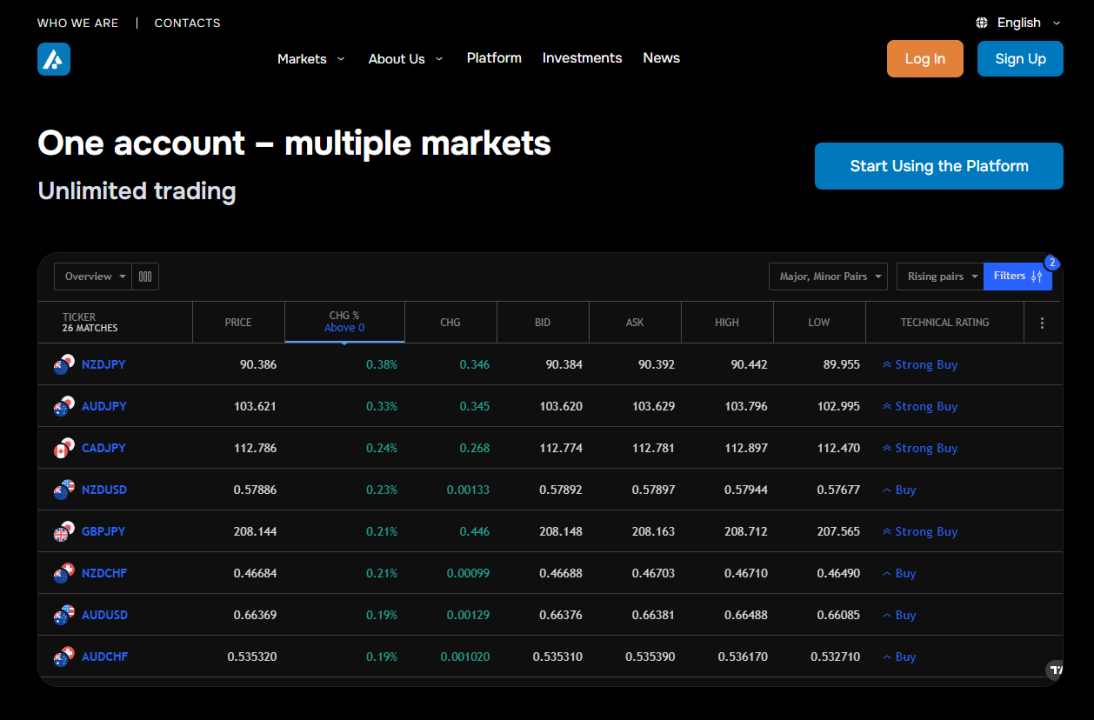

Charts and market data displayed do not consistently align with real market conditions, raising doubts about whether the platform provides access to actual financial markets.

Trading Instruments

Apexairtek claims to offer trading in:

- Forex

- Commodities

- Indices

- Stocks

- Cryptocurrencies

However, there is no proof that any of these instruments are linked to real liquidity providers or exchanges.

Account Types

Account Options

The broker promotes several account tiers with different minimum deposits. The higher the tier, the higher the deposit requirement.

Account Structure Concerns

The conditions offered on each tier appear generic and lack precise terms:

- No clear information about spreads

- No transparency on commissions

- No details on execution model

- No risk disclosures

The structure is typical of unregulated brokers designed to maximize deposits rather than provide real services.

Trading Plans

Offered Plans

Apexairtek claims to provide:

- Personalized trading strategies

- Expert guidance

- Portfolio recommendations

No information is given about the credentials or experience of the “experts” responsible for these plans.

Real Functionality

User reports indicate that these plans are used mainly as tools to pressure clients into making additional deposits, not as genuine investment solutions.

Deposits

How Deposits Work

Clients are encouraged to fund accounts via:

- Bank transfers

- Credit cards

- Digital payment options

Deposits are processed quickly, but funds become effectively inaccessible once deposited.

Deposit Pressure

Clients report consistent pressure from “personal managers” to increase balances, upgrade account tiers, or add funds to unlock supposed benefits.

Withdrawals

Withdrawal Issues

The most serious problem reported is the inability to withdraw funds. Common scenarios include:

- Repeated identity verification requests

- Unexpected taxes and fees

- Demands for additional deposits before withdrawal

- Claims of technical errors or system delays

- Sudden account freezes

Withdrawal Outcome

There are no confirmed cases of clients successfully withdrawing money. All evidence suggests systematic refusal of withdrawals.

Customer Support

Support Quality

Apexairtek advertises 24/7 support, but responses are inconsistent. Based on user feedback:

- Managers stop communicating after deposits

- Emails remain unanswered

- Phone numbers become inactive

- Support tickets are ignored

This pattern aligns with high-risk, unregulated brokers.

Client Feedback

What Clients Report

Common complaints across forums and review websites include:

- Fake profits shown in the account

- Incorrect or manipulated charts

- Aggressive deposit requests

- No access to funds

- Instant account blocking

- False promises regarding trading or withdrawals

The volume and similarity of complaints indicate a repeatable fraudulent pattern.

Red Flags

Key Warning Signs

Apexairtek displays multiple indicators typical of scam brokers:

- No regulation

- No real company data

- Recently created websites

- Fake office addresses

- Anonymous ownership

- No transparency on trading conditions

- Withdrawal obstructions

- Matching structure with known scam networks

These warning signs should be taken seriously by any investor.

Risk Summary

Why Apexairtek Is High-Risk

The broker lacks every essential element required for safe investment:

- No license

- No legal accountability

- No verified trading

- No real track record

- No corporate transparency

- No successful withdrawal cases

The evidence suggests that Apexairtek operates primarily to collect deposits and does not provide genuine financial services.

Conclusion

Apexairtek does not meet the standards of a legitimate broker. Its lack of regulation, unverifiable company information, questionable trading environment, and widespread complaints make the platform extremely unsafe for investors. All available information points to a high probability of fraudulent activity.

Investors should avoid Apexairtek and refrain from depositing any funds with this platform.