Cntly Broker Review & Information (2025)

Cntly, previously operating under domains cntly.co and m.cntly.co, is part of a larger offshore brokerage network linked to Pocket Option and dozens of affiliated websites. While the company claims European oversight and promises cutting-edge trading opportunities, investigations reveal that it operates without valid licenses, relies on misleading marketing tactics, and has already been blacklisted by regulators. In this review, we examine Cntly’s regulatory claims, trading conditions, account types, platform, and the experiences reported by traders.

Regulation and Legal Status

Cntly falsely advertised regulation by the Cyprus Securities and Exchange Commission (CySEC) with license №34578 — a license number that does not exist in CySEC’s official registry. Further checks show that Cntly is absent from the databases of recognized authorities such as the FCA (UK), ASIC (Australia), and the Central Bank of Russia.

Instead, the broker is registered offshore:

- Cntly — in Saint Vincent and the Grenadines, where forex/CFD brokers operate without government oversight.

- Pocket Option (PO Trade Ltd) — in Saint Lucia, another offshore jurisdiction with weak investor protections.

In 2021, the Central Bank of Russia officially placed cntly.co and related Pocket Option domains on its blacklist of companies engaged in illegal financial activities. The French AMF also issued warnings against Pocket Option. These signals confirm that the network operates outside the law in major markets.

Account Types

Cntly offered several account tiers, differentiated by:

- Minimum deposit amounts.

- Bonus percentages for new clients.

- Access to advanced tools or “VIP” services.

- Priority in customer support.

However, terms were unstable — account conditions frequently changed without notice, making it impossible for clients to plan long-term strategies. Some traders reported sudden alterations to leverage, spreads, or withdrawal rules, all decided unilaterally by the broker.

Commissions and Fees

The cost of trading with Cntly is unusually high and structured to disadvantage clients:

- Withdrawal fees: 25–40% of the requested amount.

- Dormancy fees: applied after periods of inactivity.

- Hidden charges: clients have reported unexpected “tax” or “insurance” fees before withdrawals are processed.

Even after paying such commissions, many traders report that withdrawals are never completed.

Trading Instruments

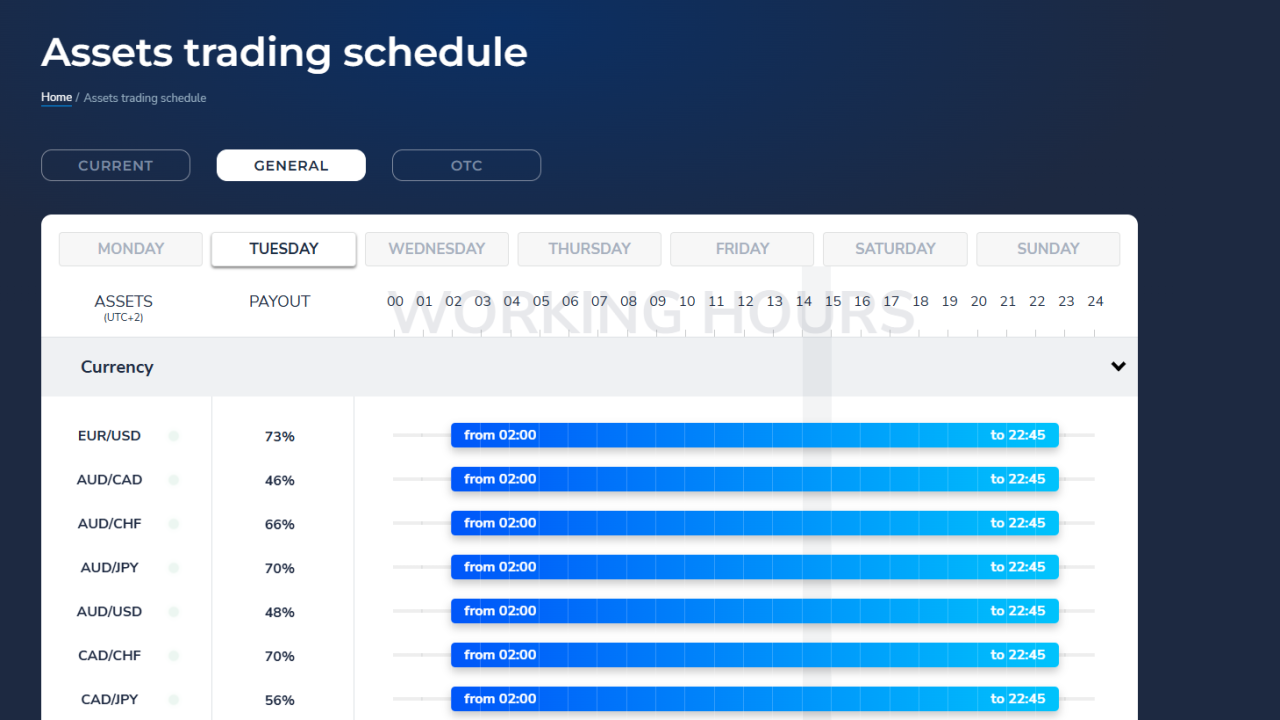

Like Pocket Option, Cntly focuses heavily on binary options, supported by a small range of CFDs. Available assets include:

- Currencies (Forex)

- Cryptocurrencies

- Stocks (limited selection)

- Commodities

The emphasis on binary options — a highly speculative product banned or restricted in many jurisdictions — already raises red flags. Combined with the broker’s lack of regulation, this creates a very risky trading environment.

Trading Platform

Cntly’s trading platform is a direct clone of Pocket Option’s proprietary system:

- Interface: nearly identical design, color scheme, and navigation.

- Access: available on web browsers and mobile applications.

- Features: binary options with fixed expiry times, CFDs, basic charting tools, copy trading, and trading tournaments.

The platform operates in a closed environment, not connected to independent liquidity providers. This means the broker controls pricing and execution, allowing manipulation of quotes, delayed order execution (reported delays of 12–72 hours), and ignored stop-loss orders.

Pros and Cons

Pros

- User-friendly interface and mobile compatibility.

- Demo account available.

- Wide marketing reach in multiple languages.

Cons

- Completely unregulated; false claims of CySEC licensing.

- Offshore registration (Saint Vincent and Saint Lucia).

- Officially blacklisted by regulators (CBR, AMF).

- Withdrawal commissions as high as 40%.

- Numerous reports of frozen accounts and threats to clients.

- Focus on binary options, banned in many jurisdictions.

- Unstable account terms; rules changed unilaterally.

Conclusion

Cntly is not a trustworthy broker. It is part of an offshore network tied to Pocket Option, already flagged by multiple regulators. The company’s licensing claims are false, its trading conditions are abusive, and client testimonials confirm patterns of fraud: frozen accounts, manipulated trades, and denied withdrawals.

Final verdict: Cntly should be regarded as a scam broker. Investors are strongly advised to avoid it and instead choose licensed brokers regulated by authorities such as the FCA, ASIC, or CySEC, where transparency and investor protection are guaranteed.

Total scam. They keep asking for more deposits and never let you withdraw.

Andy

28.08.2025

ReplyI should’ve done more research. Their so-called platform is just a trap for beginners.

Montana

26.08.2025

ReplyLost $1,500 here. Every time I asked to withdraw, they invented a new fee I had to pay first...

Inna

18.08.2025

ReplyLooks convincing at first, but the moment you want your money back, they disappear.

Morgan

13.08.2025

Reply