DigBit Exchange Review

DigBit presents itself as a modern trading platform for digital assets. However, a closer look at its structure, regulatory status, and user experience raises serious concerns about its legitimacy. This review examines DigBit through fundamental categories typically used to evaluate financial platforms — and shows why DigBit fails to meet basic industry standards.

Trading Platform

DigBit advertises a fast and efficient trading system, but user reports suggest otherwise. The platform interface appears to be built on a generic template, with features that do not match real market requirements.

Key issues reported by users include:

- charts that do not match external market data

- delayed or fake order execution

- balances that change without user actions

- incomplete or non-functional sections of the website

- missing or broken mobile applications

There is no evidence that DigBit connects to real liquidity providers or global exchanges. The trading environment appears simulated rather than genuine.

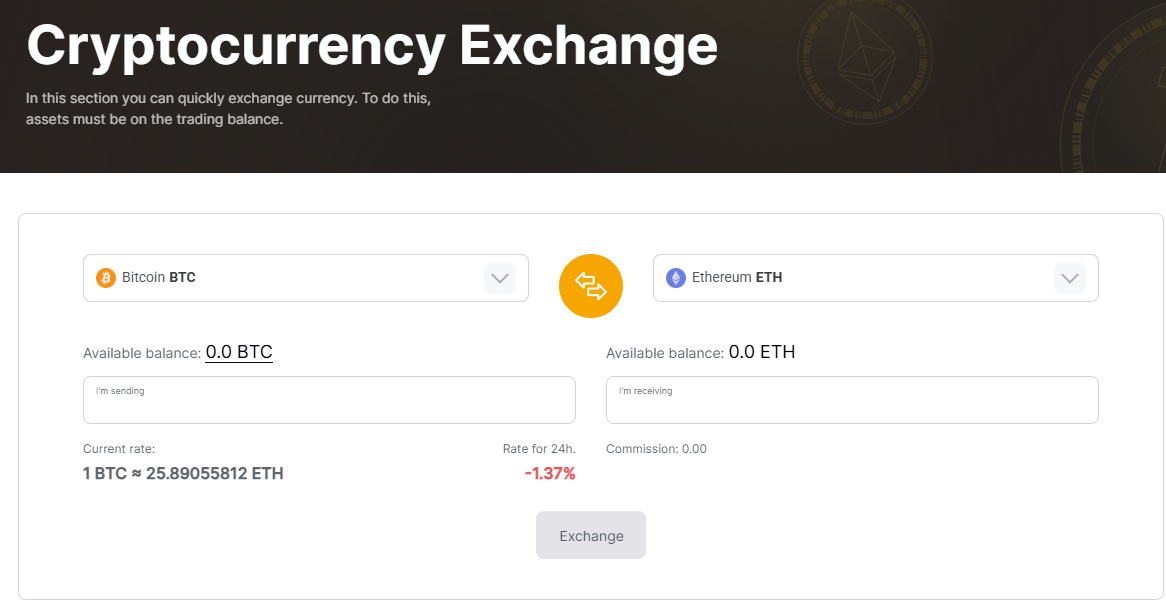

Trading Instruments

DigBit claims to offer a wide range of cryptocurrencies. However, there is no public list of supported assets, no descriptions of trading conditions, and no transparent information about spreads, fees, or leverage.

Users note that:

- the number of available pairs is unclear

- trading conditions are not documented

- price movements look artificial

- there is no transparency on how markets are formed

The lack of published trading instruments is highly unusual for a real exchange and suggests that the platform’s market data may be fabricated.

Trading Conditions

A legitimate exchange provides detailed conditions: spreads, fees, withdrawal limits, execution policy, slippage rules, and margin requirements. DigBit does not publish any of these standards.

Instead, users encounter:

- undisclosed commissions

- sudden “extra fees” added when requesting withdrawals

- fluctuating spreads that do not match the crypto market

- price manipulation inside the terminal

When a platform hides its trading conditions, it generally means the conditions are designed to benefit the platform, not the trader.

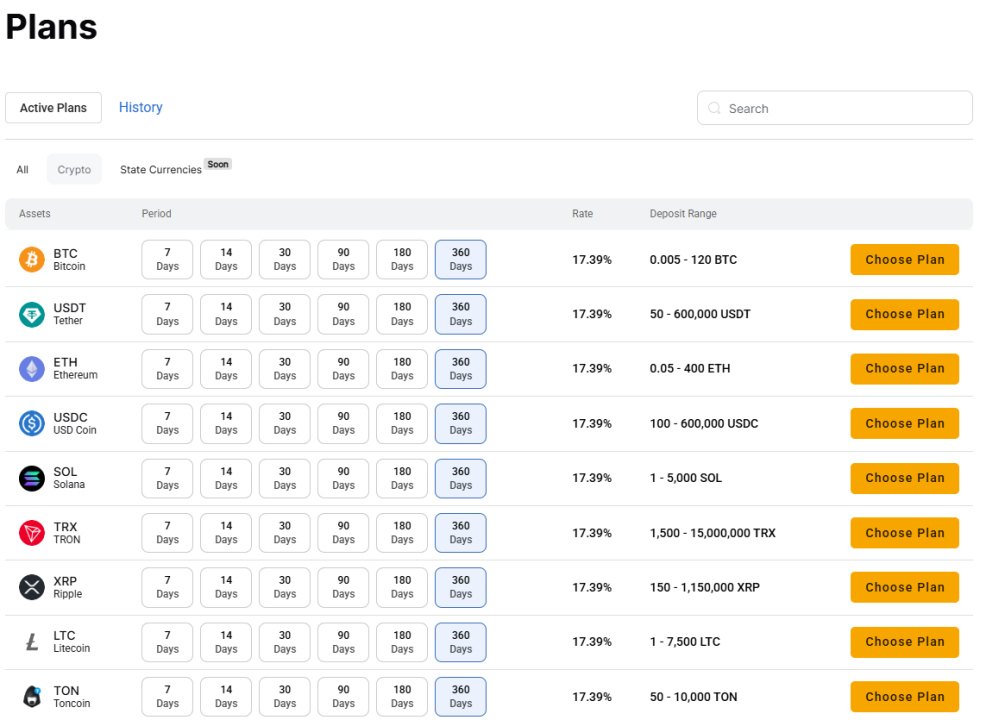

Accounts and Plans

DigBit does not provide clear information about account types or plans. Most reputable exchanges offer:

- basic accounts

- advanced accounts

- institutional accounts

- VIP fee tiers

DigBit offers none of this.

Users receive no details about:

- minimum deposits

- account tiers

- benefits

- verification levels

- fee structure

Instead, DigBit focuses heavily on promotional bonuses and “special offers,” which are common tools used by fraudulent brokers to attract deposits.

Bonuses and Promotions

DigBit has been reported to advertise unrealistic bonuses, including:

- free crypto tokens

- welcome bonuses

- “guaranteed profits”

- limited-time earning programs

These offers often require users to deposit funds to “unlock” bonuses, but the withdrawals never occur. Such promotions are widely recognized as a red flag in the online trading world.

Regulation

This is the most critical section — and also the most alarming. DigBit is not regulated by any financial authority. The platform provides no:

- license number

- regulatory jurisdiction

- company registration

- compliance documentation (AML, KYC, privacy policies)

- physical address

- legal agreement or terms of service

Operating without regulation means:

- users have no protection

- funds are not insured

- disputes cannot be resolved legally

- the company cannot be held accountable

- owners remain completely anonymous

This lack of legal oversight alone makes DigBit a high-risk platform.

Security

A legitimate exchange protects user data and funds with advanced systems, such as:

- cold storage

- multi-signature wallets

- audited smart contracts

- DDoS protection

- encryption standards

DigBit does not provide evidence of any of these protections.

In addition, several browser security tools have flagged DigBit’s website as unsafe, suggesting risks related to phishing, malware, or insecure server settings.

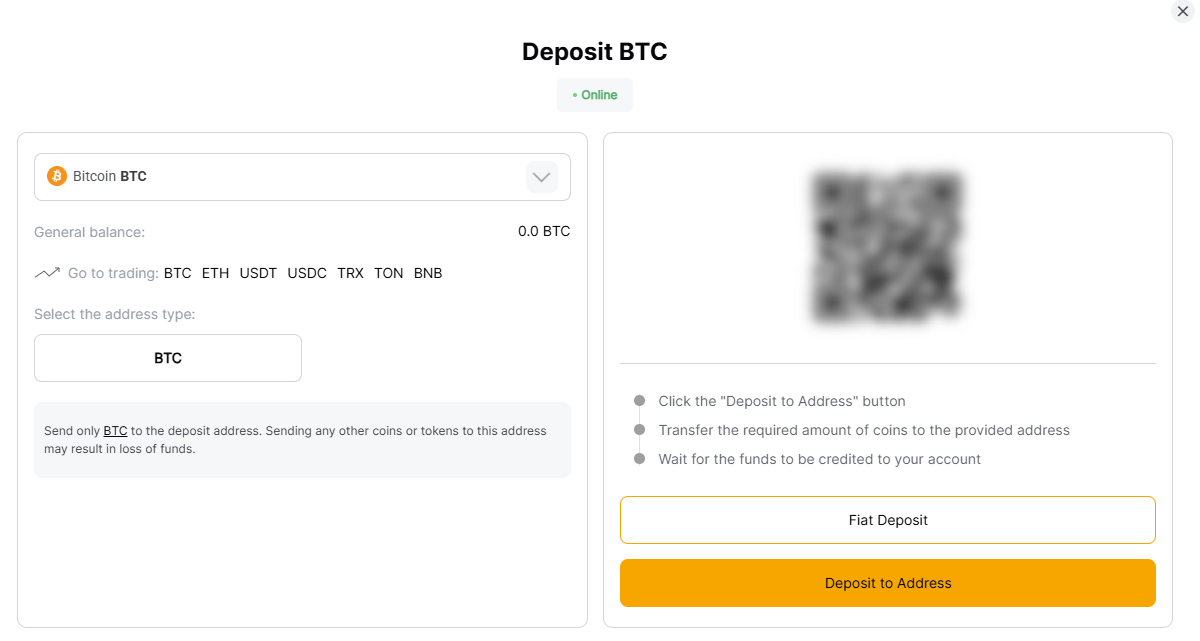

Deposits and Withdrawals

Most user complaints revolve around the withdrawal process.

Typical issues include:

- withdrawals permanently “pending”

- blocked accounts after attempting to withdraw

- requests for repeated verification

- disappearance of funds

- complete silence from customer support

A repeated pattern is the demand for additional charges such as:

- withdrawal fees

- transfer taxes

- verification deposits

- insurance payments

- unlocking fees

These are requested through external wallet transfers, not through internal balances — a classic sign of a fraudulent withdrawal-blocking scheme.

Customer Support

Customer support plays a key role in any financial service. DigBit’s support structure shows major deficiencies:

- responses are automated

- no real operator is available

- emails go unanswered

- messages stop once withdrawals are requested

This is consistent with platforms that operate outside legitimate business standards.

User Feedback

Independent reviews describe DigBit as:

- unregulated

- unresponsive

- unable to process withdrawals

- misleading in its advertising

- manipulative in trading conditions

- artificial in its trading environment

Many users report complete loss of funds, while others describe repeated pressure to make additional payments that ultimately lead nowhere.

Risks

Depositing funds on DigBit exposes users to the following risks:

- irreversible financial loss

- identity theft from fake verification

- exposure to phishing or malware

- fabricated market conditions

- manipulation of account balances

- psychological pressure to deposit more money

Without regulation, there is no legal path to recover funds directly from the platform.

Conclusion

DigBit markets itself as a versatile crypto trading platform, but lacks the essential components of a legitimate exchange. With no regulation, no transparency, no verifiable ownership, and a long list of unresolved user complaints, DigBit cannot be considered safe for trading or investment purposes.

The platform exhibits multiple signs of a high-risk or fraudulent operation. Users are strongly advised to avoid DigBit and seek secure, regulated alternatives.