Exnova Broker Review

Exnova has become a widely discussed name in the online trading space. Advertised as a progressive broker offering a smooth user experience, it claims to serve traders with low entry costs, a variety of tradable assets, and advanced tools. But as with many emerging platforms, it’s critical to assess whether these promises are supported by facts — or if they conceal underlying issues. This review aims to provide an honest, fact-based analysis of Exnova, focusing on its licensing, credibility, client experience, and trading environment.

Company Background and Transparency

Exnova’s corporate background is vague. Some references suggest that it is operated by a company called Digital Smart LLC. However, there are inconsistencies regarding the jurisdiction under which it operates — with mentions of Cyprus and Saint Kitts and Nevis, both of which are known for loose regulatory environments.

Notably, the Exnova website does not provide corporate registration numbers, names of responsible individuals, physical office addresses, or links to verifiable documentation. This lack of transparency creates immediate doubt about the legitimacy and legal accountability of the broker.

Licensing Status

Regulation is the gold standard for assessing a broker’s legitimacy. Exnova, however, is not licensed by any established financial regulator. There is no oversight from the FCA (UK), CySEC (Cyprus), ASIC (Australia), or any other tier-1 body.

This means that Exnova is not legally bound to follow best practices, uphold client protections, or maintain segregated funds. For traders, this creates significant vulnerability. Any issues related to withdrawal delays, platform errors, or manipulation cannot be escalated to a regulatory body for resolution.

Access and Registration

Registering with Exnova is relatively easy and requires minimal personal verification. This may be convenient for some users, but it raises concerns about anti-money laundering (AML) compliance and data protection.

The platform claims to restrict access from certain jurisdictions such as EU countries and Russia. However, traders from these regions have reported being able to register and trade after bypassing geographic blocks using VPN services. This further questions the platform’s adherence to international compliance standards.

Trading Instruments and Platform Overview

Exnova offers trading on multiple asset classes including:

- Forex

- Cryptocurrencies

- Stocks

- Commodities

- Binary and digital options

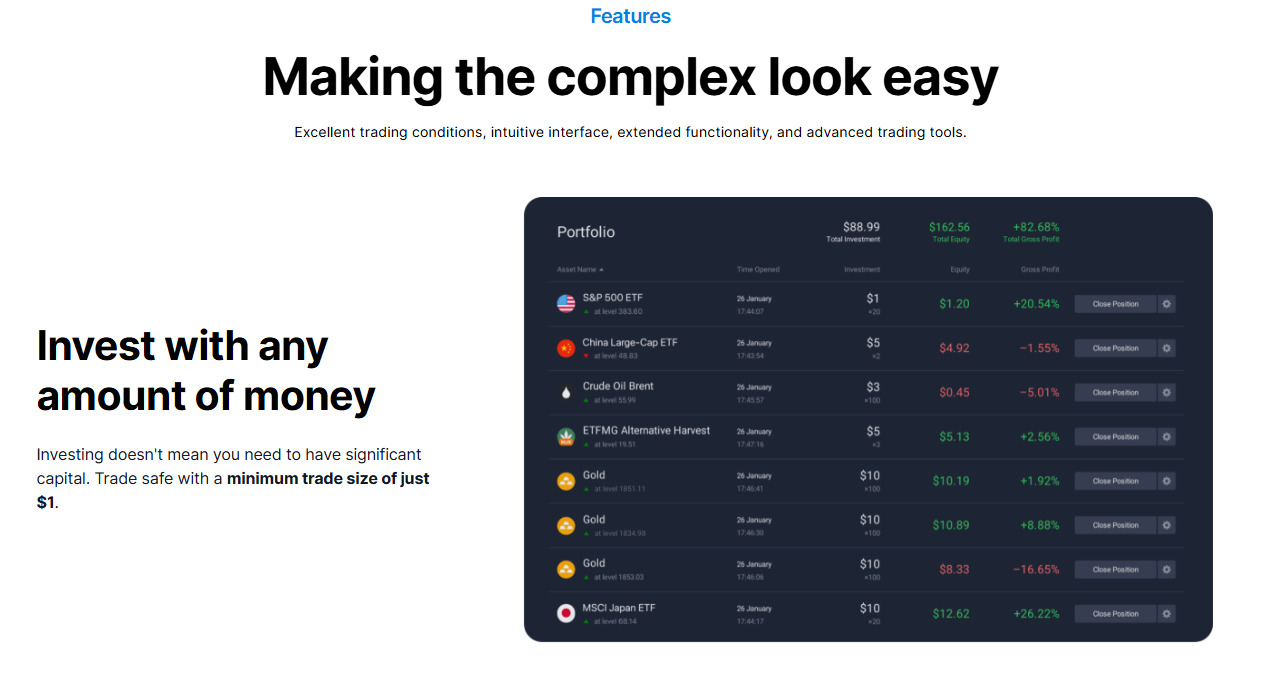

Trades can be initiated with as little as $1. The minimum deposit is $10. Leverage reportedly reaches up to 1:500, which can be dangerous for inexperienced users.

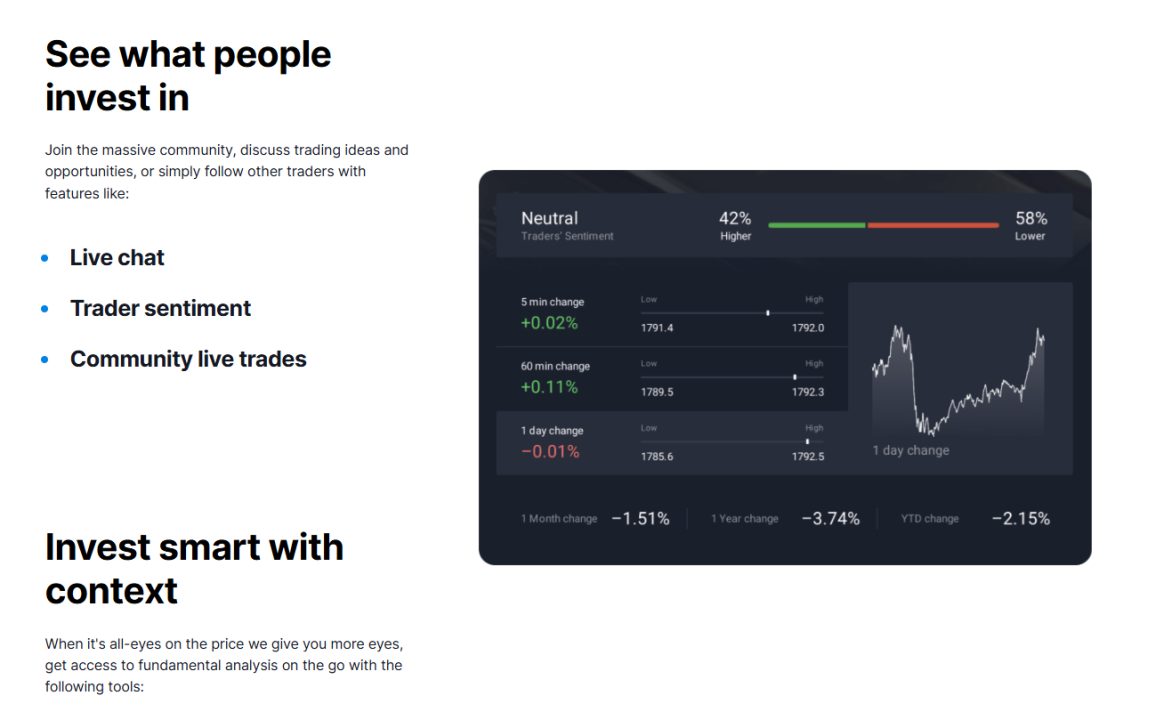

The trading platform itself is web-based, with additional access via an Android app. There is no iOS app or integration with trusted tools like MetaTrader. The platform’s design appears clean and beginner-friendly, but user reports highlight problems with trade execution, freezing during high market volatility, and unexplained quote discrepancies.

Bonuses and Account Restrictions

Bonuses are a recurring point of contention among Exnova users. While promotions may seem generous, they often lock users into strict terms and conditions. Traders have reported that receiving a bonus can automatically restrict their ability to withdraw funds unless they meet high-volume trading requirements.

In many cases, bonuses are allegedly added to accounts without the user explicitly requesting them. This tactic allows the broker to block withdrawals on the basis of bonus-related clauses — an unethical and exploitative approach.

Customer Service and Complaint Handling

Support options on Exnova are limited. There is no live chat or telephone support. Users must rely on email communication, which is often slow or non-existent, according to reviews.

Traders have described their experience with support as frustrating and unhelpful, particularly when seeking clarity on account suspensions or blocked withdrawals. This is particularly concerning given that users have no external channels to address disputes.

Client Feedback and Online Presence

Reviews of Exnova across forums, watchdog sites, and social media reveal consistent patterns:

- Withdrawals being delayed or denied

- Accounts being closed without warning

- Poor customer communication

- Dubious use of bonuses to restrict fund access

- Questionable platform behavior during volatile trading sessions

Although some users note the platform’s ease of use or accessibility, these benefits are outweighed by the recurring reports of serious operational concerns.

Conclusion

Exnova may offer a seemingly accessible gateway into online trading, but the risks far outweigh the benefits. The lack of regulation, anonymity of its operations, exploitative bonus policies, and unreliable customer service lmake this broker a highly risky option for any trader.

Until Exnova becomes a transparent, licensed, and accountable brokerage firm, it should not be trusted with user funds. Traders are strongly advised to consider alternative brokers that meet industry standards and provide adequate protections. Financial safety and integrity should always take precedence over marketing claims and easy signups.