Netteck Broker Review

Netteck presents itself as an international brokerage platform offering access to global financial markets. The company promotes trading in forex, stocks, indices, commodities, and cryptocurrencies while emphasizing modern technology and supposedly professional service.

At first glance, the platform attempts to create the image of a legitimate broker. However, a closer examination shows that Netteck fails to provide the level of transparency expected from a financial company handling client funds. Critical information is missing, key claims cannot be verified, and many operational details remain unclear.

Taken together, these factors position Netteck as a high-risk broker that should be approached with extreme caution.

Regulation

Netteck claims to operate under the supervision of several financial regulators, including:

- Financial Conduct Authority (FCA)

- Dubai Financial Services Authority (DFSA)

- Commission de Surveillance du Secteur Financier (CSSF)

- Vanuatu Financial Services Commission (VFSC)

These regulators enforce strict requirements related to capital reserves, reporting, client fund protection, and operational transparency.

Despite these claims, Netteck does not provide:

- license numbers;

- links to official regulatory registers;

- the legal entity holding the license;

- copies of authorization documents.

Public registry checks do not confirm the existence of a regulated entity connected to Netteck. Without verifiable licensing, the broker should be considered unregulated.

Unverifiable regulatory claims are one of the strongest warning signs associated with fraudulent brokerage operations.

Legal Structure

Netteck lists a business address in Buenos Aires, Argentina. Beyond this, there is no meaningful corporate disclosure.

The broker does not reveal:

- the registered company name;

- company registration number;

- ownership structure;

- executive leadership;

- audited financial statements.

An address alone does not establish legal accountability. Clients cannot determine who controls the platform or which jurisdiction governs their relationship with the broker.

This level of corporate anonymity is incompatible with industry standards.

Websites and Domains

Netteck operates through at least two domains:

- netteck.xyz

- net-teck.biz

The primary domain was registered in 2018, while the secondary domain appeared later. The use of multiple similar domains is frequently associated with high-risk brokers. It allows operators to shift operations quickly, minimize reputational damage, and continue attracting clients if one website becomes compromised.

Established brokers typically maintain a single domain clearly connected to a licensed entity. No such connection is visible in this case.

Trading Platform

Netteck states that it provides a proprietary browser-based trading platform accessible from any device without software installation.

However, the broker does not disclose critical technical information:

- the order execution model;

- whether trades are routed externally or handled internally;

- liquidity providers;

- independent audits;

- platform specifications.

There is also no support for widely recognized platforms such as MetaTrader 4 or MetaTrader 5.

Without transparency, clients cannot verify whether trading activity reflects real market conditions. If trades are processed internally, the broker effectively controls pricing and outcomes.

This represents a significant operational risk.

Trading Instruments

Netteck advertises access to a typical range of assets:

- forex currency pairs;

- equities;

- stock indices;

- metals;

- commodities;

- cryptocurrencies.

No details are provided regarding execution venues, counterparties, or market connections. Listing asset classes alone does not confirm actual market access and is commonly used by unregulated brokers to create the appearance of legitimacy.

Trading Accounts

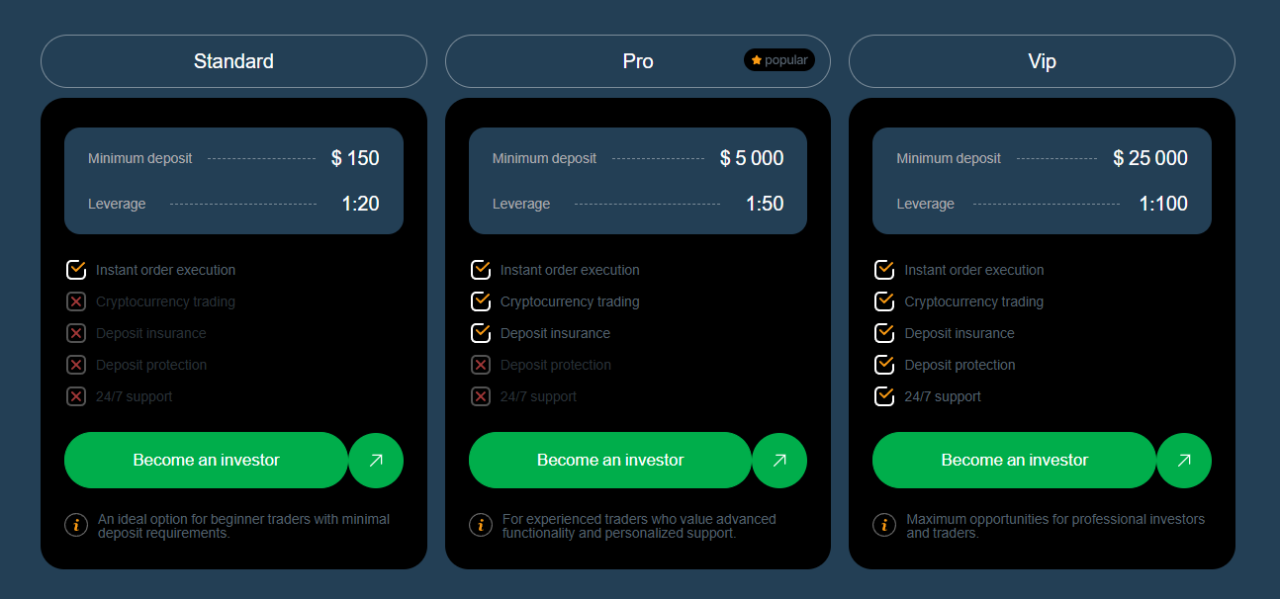

The broker offers three account tiers:

- Standard — minimum deposit $150, leverage up to 1:20

- Pro — minimum deposit $5,000, leverage up to 1:50

- VIP — minimum deposit $25,000, leverage up to 1:100

Higher-tier accounts are marketed with additional benefits such as fund protection, insurance, and enhanced support.

However, the broker does not explain:

- how the insurance operates;

- who provides it;

- whether it is legally enforceable;

- under what conditions protection applies.

These claims appear promotional rather than contractual.

The account structure suggests a strategy focused on encouraging larger deposits instead of providing transparent trading conditions.

Trading Conditions

One of the most serious concerns is the lack of clear trading terms.

Netteck does not publish:

- spreads;

- commissions;

- swap rates;

- margin call thresholds;

- stop-out levels;

- additional trading costs.

Clients are expected to deposit funds without understanding the pricing model. Such opacity is unacceptable for a legitimate broker and significantly increases financial risk.

Deposits and Withdrawals

According to the website, funding methods include:

- cryptocurrencies;

- bank cards;

- bank transfers;

- electronic payment systems.

Withdrawal requests are said to be processed within two days.

However, the broker fails to disclose:

- withdrawal fees;

- transaction limits;

- possible delays;

- rejection conditions;

- formal AML/KYC procedures.

Crypto payments are particularly concerning because they are difficult to reverse once completed.

Unclear withdrawal policies are a common feature among high-risk brokers.

Legal Documents and Client Protection

Netteck does not provide a comprehensive legal framework governing its relationship with clients.

Missing disclosures include:

- enforceable client agreements;

- detailed refund policies;

- fund segregation statements;

- investor protection mechanisms;

- transparent verification procedures.

Without these safeguards, client funds may not be protected.

User Complaints

Available independent feedback describes patterns frequently linked to unregulated brokers:

- aggressive sales tactics;

- repeated pressure to deposit additional funds;

- promises of fast or unusually high returns;

- withdrawal difficulties;

- additional payment demands before processing withdrawals.

While individual complaints should always be evaluated carefully, their consistency aligns with known high-risk brokerage behavior.

Key Risk Indicators

Multiple warning signs appear simultaneously:

- unverifiable regulatory claims;

- lack of corporate transparency;

- anonymous ownership;

- multiple domains;

- undefined trading infrastructure;

- hidden trading costs;

- unclear withdrawal procedures;

- reliance on crypto payments.

Together, these indicators form a strong risk profile.

Conclusion

Netteck does not meet the transparency standards expected from a trustworthy brokerage. Essential elements that normally protect investors — verified regulation, corporate disclosure, clear trading conditions, and defined withdrawal rules — are either missing or undisclosed.

There are no objective reasons to consider Netteck a safe broker. On the contrary, the available information suggests a platform operating with significant opacity and elevated financial risk.

Engaging with Netteck may result in the loss of funds. Investors are strongly advised to avoid depositing money with this broker and to work only with companies that provide verifiable licensing, transparent ownership, and fully documented trading conditions.