RossKitWay Review and Information 2025

RossKitWay (rosskitway.com) advertises itself as a global investment and brokerage platform, offering clients access to forex, stocks, commodities, and cryptocurrencies. The company presents itself as a professional, “trustworthy” brand with unique investment strategies and high profitability.

In practice, RossKitWay has no valid regulation, operates through an offshore registration, and has already been flagged by the Central Bank of Russia as a financial pyramid.

Regulation

RossKitWay claims to hold multiple licenses, including FCA (UK), CySEC (Cyprus), and even the Central Bank of Russia. A check of official registers shows that these licenses do not exist.

Instead, the company is registered offshore in Saint Vincent and the Grenadines, a jurisdiction well-known for hosting unregulated and fraudulent brokers. On August 1, 2025, the Central Bank of Russia officially blacklisted RossKitWay, citing signs of pyramid activity.

Verdict: RossKitWay operates illegally without any oversight.

Account Types

RossKitWay promotes several account tiers:

-

Basic — Entry-level account, minimum deposit from $250–500, limited tools.

-

Silver / Gold — Larger deposits (from $2,000 upwards), additional features, “priority support.”

-

VIP — Deposits from $10,000+, “exclusive strategies,” daily higher returns.

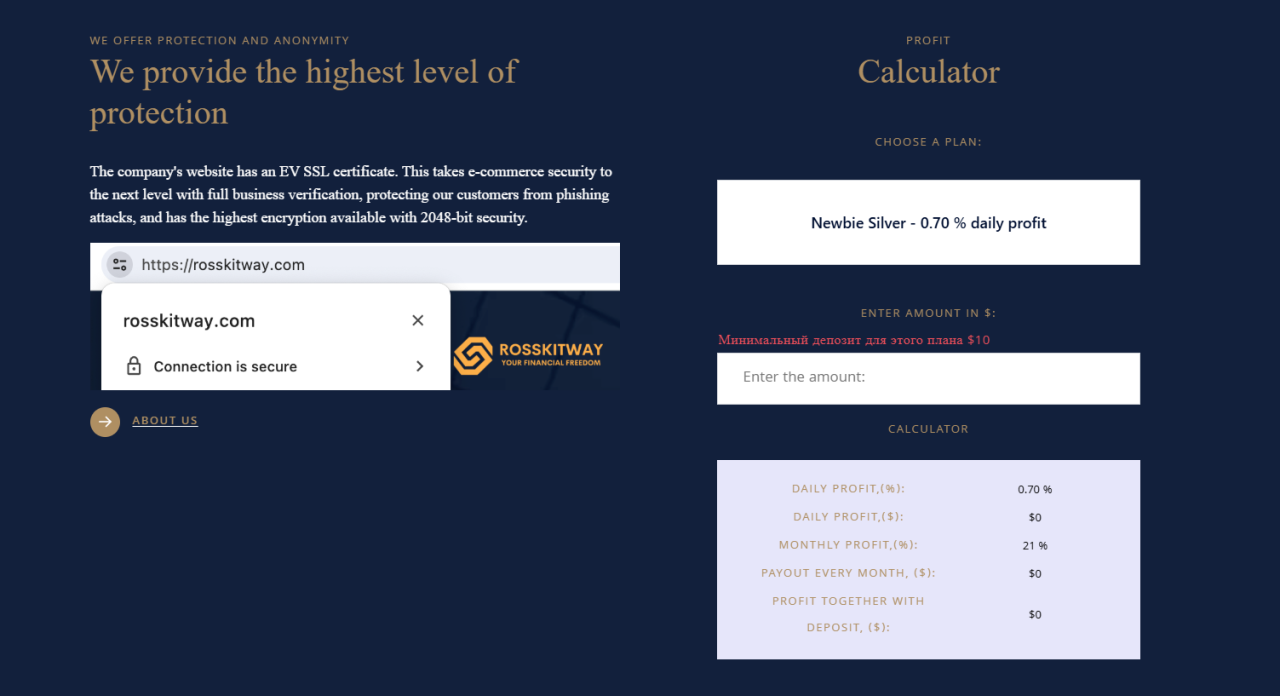

The accounts are marketed more like investment plans with promised yields than real brokerage accounts. Advertised returns reach up to 4% daily, which is impossible in legitimate trading.

Commissions and Fees

RossKitWay provides no transparent information about spreads, commissions, or margin requirements. Instead, victims report:

-

Hidden “taxes” or “verification fees” demanded before withdrawals.

-

Extra payments labeled as “commissions” to unlock access to profits.

These practices differ from legitimate brokers, who publish clear fee structures.

Trading Instruments

RossKitWay advertises a broad range of products:

-

Forex pairs

-

CFDs on stocks and indices

-

Commodities (gold, oil, agricultural goods)

-

Cryptocurrencies (BTC, ETH, USDT, and more)

In reality, the platform does not connect to regulated markets. All trading activity occurs in a closed-loop system, meaning the “prices” and “profits” are generated internally.

Platform and Software

Unlike regulated brokers that rely on industry-standard tools like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), RossKitWay only provides a proprietary web interface.

This platform:

-

Simulates trading activity without execution on live markets.

-

Displays artificial profits to convince users to deposit more.

-

Lacks transparency and third-party audits.

Pros and Cons

Pros (on the surface):

-

Wide selection of instruments (as advertised).

-

Quick and easy account setup.

-

Multiple deposit options including crypto.

Cons (in reality):

-

Unregulated and blacklisted by regulators.

-

Fake licenses and offshore registration.

-

Unrealistic promises of 200%+ annual returns.

-

No MT4/MT5 platform, only a web simulator.

-

Reports of blocked withdrawals and forced extra payments.

-

Anonymous ownership and hidden contact details.

Conclusion

RossKitWay is not a real broker but a fraudulent investment scheme. With no regulation, fake licensing claims, opaque fees, and a blacklisting from the Central Bank of Russia, the company presents clear dangers to investors.

Any money deposited is at high risk of being lost, and victims report systematic refusal of withdrawals. RossKitWay should be avoided at all costs.

Rosskitway is fake. Spread the word before others get scammed too.

Rendal

28.08.2025

ReplyWorst experience ever. They robbed me of $5,000.

victor_tipene

17.08.2025

ReplyThey promised me profits, but it was all fabricated data on their platform.

benfooty

13.08.2025

ReplyThe moment I stopped depositing more, my account was locked.

Investor

02.08.2025

Reply