TradeVisor Broker Review

TradeVisor (tradevisor.ai) presents itself as a brokerage and copy trading platform offering automated trading solutions across multiple financial markets. The website uses familiar language about professional traders, risk management, and accessibility for beginners. However, a detailed investigation shows that TradeVisor lacks transparency, operates without regulation, and demonstrates multiple characteristics commonly associated with fraudulent trading platforms.

General Company Information

TradeVisor does not disclose any verified corporate details. The website does not identify the legal entity operating the platform, the country of registration, a company registration number, or a physical office address. There is no information about the owners, directors, or management team.

Users are effectively transferring funds to an anonymous structure with no identifiable legal responsibility. In the financial industry, this level of opacity represents a major and unacceptable risk.

Regulation

TradeVisor does not claim to hold any financial license and does not name a supervising authority. Checks against major regulatory registers, including the FCA, CySEC, DFSA, and IFSC, do not list TradeVisor as an authorized broker or investment service provider.

Operating without regulation means:

- client funds are not legally protected,

- there is no obligation to use segregated accounts,

- no investor compensation schemes apply,

- there is no regulator to handle disputes or misconduct.

This places all financial risk entirely on the client.

Websites and Domains

TradeVisor claims long-term market experience, including statements suggesting more than ten years of operation. These claims are not supported by technical evidence.

The domain tradevisor.ai was registered relatively recently. There is no confirmed historical presence, no archived versions showing long-term activity, and no independent references dating back several years. This contradiction between marketing claims and technical facts strongly suggests misrepresentation.

Trading Platform

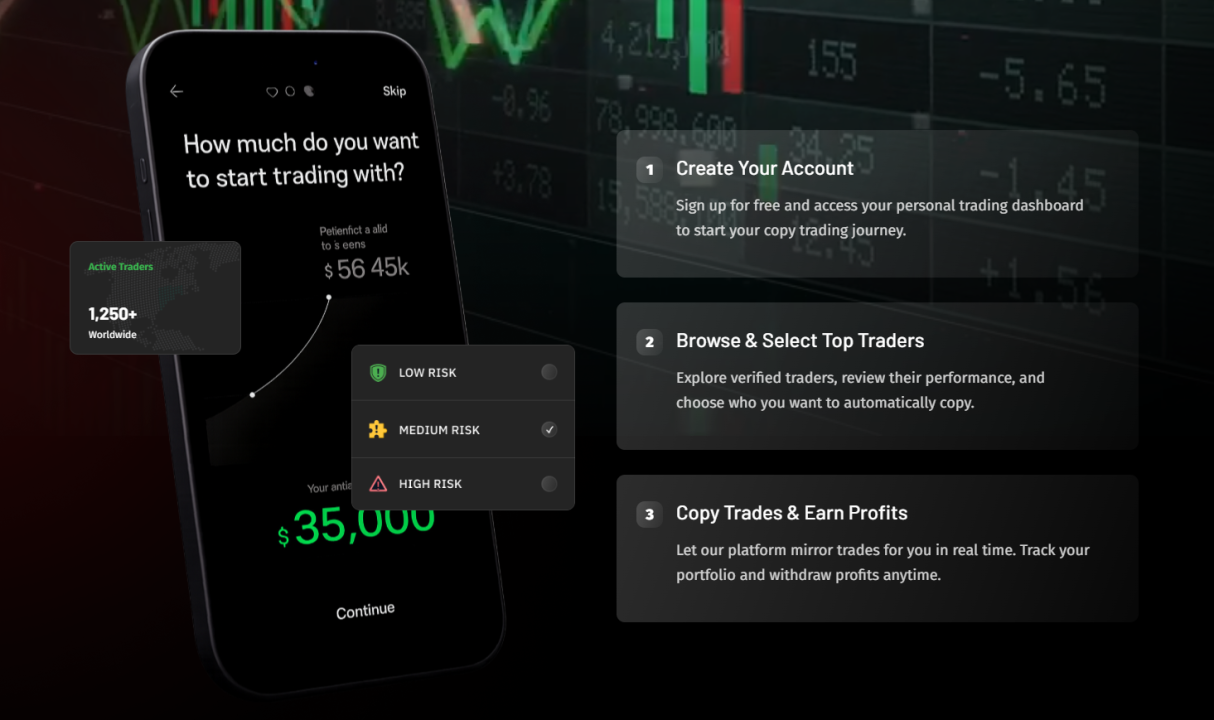

TradeVisor claims to provide access to trading in:

- Forex currency pairs,

- CFDs,

- cryptocurrencies,

- commodities,

- stock indices.

The platform also states support for MetaTrader 4 and MetaTrader 5.

However, essential details are missing. TradeVisor does not disclose:

- which broker executes trades,

- whether real market access exists,

- who provides liquidity,

- how orders are routed and filled.

Without this information, it is impossible to verify whether trading is real or simulated within an internal system.

Trading Accounts

The website provides no clear information about trading accounts. There are no details regarding:

- account types,

- minimum deposit requirements,

- account tiers,

- client eligibility or restrictions.

When a broker withholds basic account information, users cannot assess financial exposure before depositing funds.

Trading Conditions

TradeVisor does not publish its trading conditions. The following information is completely absent:

- spreads,

- commissions,

- leverage levels,

- margin requirements,

- execution model (STP, ECN, or dealing desk),

- trading costs.

This lack of disclosure prevents any meaningful evaluation of risk or trading expenses. For a legitimate broker, such opacity would be unacceptable.

Deposits and Withdrawals

Withdrawal practices represent the most serious concern.

Based on user complaints, a consistent pattern emerges:

- deposits are accepted quickly,

- accounts may initially show profits,

- withdrawal requests trigger unexpected payment demands.

Clients report being asked to pay additional charges described as:

- taxes,

- verification fees,

- account activation fees,

- profit release fees.

After these payments are made, withdrawals are often delayed indefinitely or blocked altogether. In many cases, customer support stops responding.

Legitimate brokers do not collect taxes directly from clients. Taxes are paid to government authorities, not private platforms. Requests for tax payments as a condition for withdrawals are a well-known tactic used in investment scams.

Legal Documents and KYC

TradeVisor does not provide transparent legal documentation. There is no clearly defined client agreement, no detailed risk disclosure, and no explanation of dispute resolution procedures.

KYC and AML processes are either poorly described or used as a pretext to demand additional payments. This behavior does not align with standard practices of regulated brokers.

User Reviews

Online feedback about TradeVisor is inconsistent but alarming.

Positive reviews tend to be short, generic, and lacking detail. Negative reviews consistently report the same issues:

- inability to withdraw funds,

- frozen or blocked accounts,

- sudden fee demands,

- unresponsive customer support.

The repetition of these complaints across different users indicates systemic problems rather than isolated incidents.

Key Scam Indicators

TradeVisor exhibits multiple red flags associated with fraudulent platforms:

- no regulation or licensing,

- no disclosed legal entity,

- anonymous ownership,

- recently registered domain contradicting long-term claims,

- hidden trading conditions,

- manipulation of withdrawals through fictitious fees.

Conclusion

TradeVisor does not meet the basic standards of a legitimate or trustworthy broker. The absence of regulation, corporate transparency, and verifiable trading infrastructure, combined with repeated complaints about blocked withdrawals, indicates a high probability of financial loss for users.

From an analytical and risk-management perspective, TradeVisor should be considered a high-risk and potentially fraudulent platform. The clear recommendation is to avoid depositing funds and to refrain from any financial interaction with this broker.