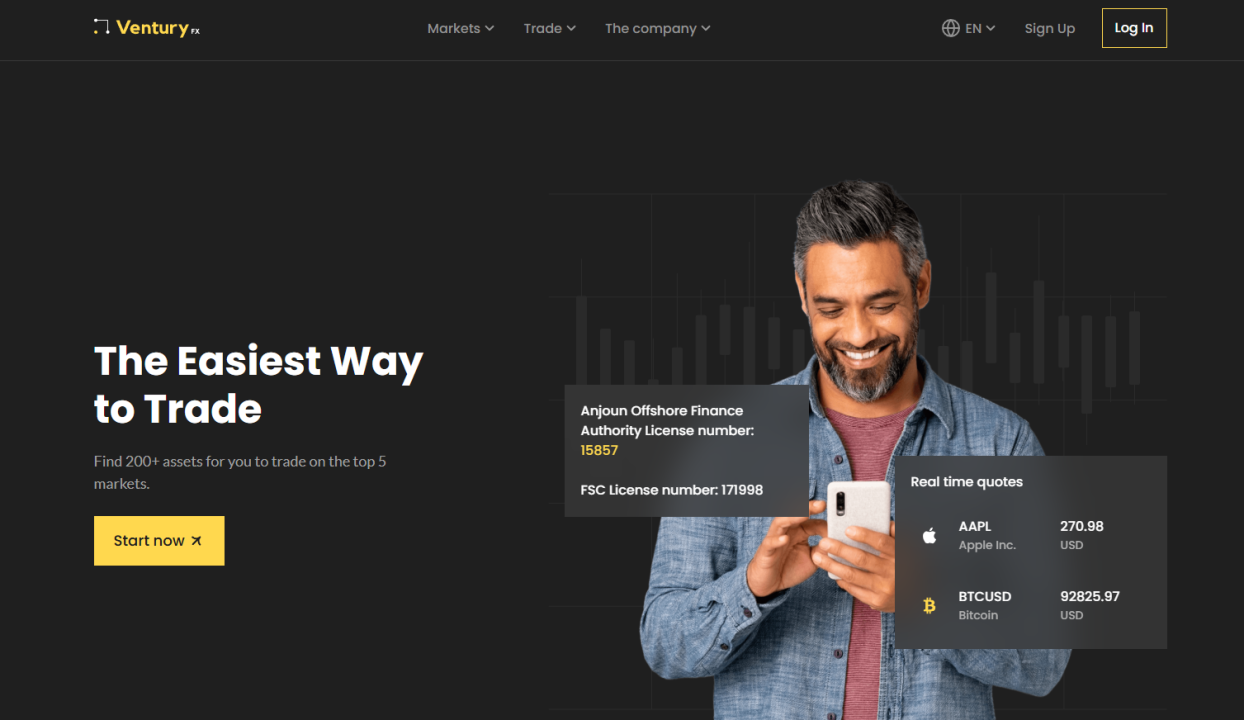

VenturyFX Broker Review

VenturyFX claims to be an international broker providing access to multiple financial markets and targeting retail traders worldwide. The company promotes itself as an established platform with offshore regulation and modern trading solutions. However, a closer examination of its legal disclosures, operational model, and client feedback reveals a pattern of risks commonly associated with pseudo-brokers rather than legitimate financial intermediaries.

This review focuses on what VenturyFX fails to disclose as much as on what it claims to offer.

Regulation

VenturyFX refers to regulation by the Financial Services Commission of Mauritius and mentions a license number. These statements are not supported by verifiable evidence.

Major regulatory concerns include:

- no published license document;

- no direct reference to an official regulator register;

- no explanation of regulatory protections for clients.

Offshore regulators such as FSC Mauritius do not provide strict supervision of forex and CFD brokers. They do not actively monitor trade execution, do not enforce strong capital requirements, and do not guarantee compensation mechanisms for retail clients. In this context, regulatory claims serve more as a credibility signal for marketing purposes than as real investor protection.

Corporate Structure

VenturyFX does not provide transparent corporate information. The website lacks clarity about the legal entity operating the platform and the individuals behind it.

Missing disclosures include:

- incorporation documents;

- names of owners and directors;

- information about ultimate beneficial beneficiaries;

- audited financial statements.

Additionally, the broker does not disclose its banking partners or explain how client funds are stored. There is no confirmation of fund segregation. For a broker accepting client deposits, this absence of information significantly increases counterparty risk.

Business Setup

Public sources associate VenturyFX with multiple related companies registered in different jurisdictions. This fragmented structure complicates accountability and makes it difficult for clients to identify the entity responsible for their funds.

Such setups typically result in:

- unclear legal responsibility;

- obstacles to filing claims or complaints;

- the ability to shift liability between affiliated companies.

This is not a structure designed to protect clients, but one that limits their legal leverage.

Trading Instruments

VenturyFX advertises a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, and stocks. While this variety appears attractive, there is no detailed documentation describing contract specifications, liquidity sources, or pricing mechanisms.

Without transparent instrument descriptions, clients cannot verify whether trades are executed on real markets or internally generated by the platform.

Trading Platform

The broker does not offer standard platforms such as MetaTrader 4 or MetaTrader 5. Instead, it relies on a proprietary web-based trading terminal.

This approach creates several risks:

- no independent audit of price feeds or execution;

- full broker control over displayed quotes and trade history;

- limited ability for clients to challenge execution disputes.

When the broker controls both the platform and the data, the client has no reliable way to independently verify trading results.

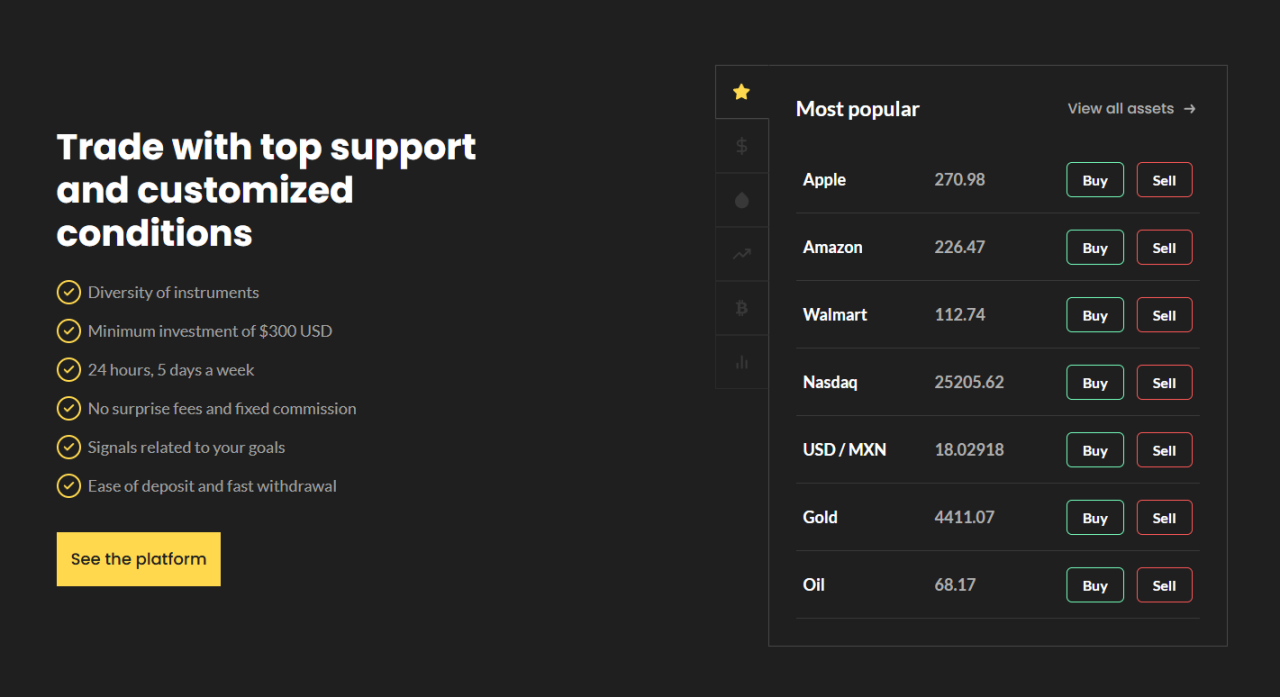

Trading Conditions

VenturyFX does not publish fixed trading conditions. Critical parameters are either missing or vaguely described.

Undisclosed elements include:

- execution model (ECN, STP, or dealing desk);

- leverage limits;

- spreads and commissions;

- margin requirements and stop-out levels.

The minimum deposit is reportedly around USD 300, but beyond this entry point, the rules are undefined. This allows the broker to adjust conditions at its discretion, often to the client’s disadvantage.

Deposits and Withdrawals

The company claims to support multiple payment methods, including cards, transfers, and cryptocurrencies. However, there is no publicly available withdrawal policy.

Clients are not informed about:

- processing timeframes;

- withdrawal fees;

- limits or conditions;

- reasons for possible rejection.

User complaints consistently show that withdrawal requests trigger delays, additional payment demands, or account restrictions. This recurring pattern is one of the strongest warning signs in the retail trading industry.

Client Feedback

VenturyFX has a predominantly negative reputation on independent review platforms. Complaints follow a consistent structure rather than isolated grievances.

Common issues reported by clients include:

- inability to withdraw funds;

- lack of response from customer support;

- pressure from managers to deposit more money;

- loss of access after refusing further deposits.

Such consistency strongly suggests a systemic operational issue rather than random service failures.

Marketing Practices

VenturyFX emphasizes trading signals, personal managers, and fast payouts in its promotional materials. These claims are not supported by transparent data.

There is no disclosure of:

- how signals are generated;

- who provides the analysis;

- any verified performance records.

Marketing appears to be designed to accelerate deposits rather than to communicate real trading value or professional expertise.

Risk Summary

Taken together, VenturyFX exhibits a cluster of high-risk indicators:

- offshore regulation with minimal oversight;

- unverifiable licensing claims;

- opaque corporate and legal structure;

- proprietary trading platform without independent control;

- undisclosed trading conditions;

- repeated complaints related to withdrawals.

Each of these factors represents a serious concern. Combined, they form a profile inconsistent with a legitimate brokerage service.

Conclusion

VenturyFX does not demonstrate the transparency, regulatory accountability, or operational integrity expected from a trustworthy broker. The lack of verifiable regulation, unclear corporate responsibility, absence of fixed trading conditions, and persistent withdrawal issues indicate a high probability of client harm.

Based on the available evidence, VenturyFX should be considered a high-risk platform. Engagement with this broker exposes traders to a significant likelihood of financial loss and cannot be recommended.