Kogza Review

Kogza (kogza.com) positions itself as a cryptocurrency exchange offering trading, investments, internal wallets, liquidity pools, and an automated trading robot. At first glance, it appears to provide a wide range of services for crypto users. A deeper analysis, however, reveals numerous red flags indicating serious operational and financial risks. The platform lacks basic transparency, accountability, and regulation expected from a legitimate exchange.

Regulatory Status

Kogza is not regulated by any recognized financial authority. It does not provide license numbers, regulatory oversight, or information about the legal entity controlling the platform. Operating without regulation exposes users to total risk. Deposits, withdrawals, and account security are not protected by law, and users have no formal recourse in case of disputes or financial loss. The absence of regulatory compliance is a critical warning sign.

Ownership and Structure

The platform provides no information about its owners, management team, or legal entity. There is no registered company, no public address, and no verifiable leadership. This lack of transparency prevents users from understanding who is responsible for the platform and makes accountability virtually impossible. Such obscurity is a common trait of fraudulent operations.

Claimed Features

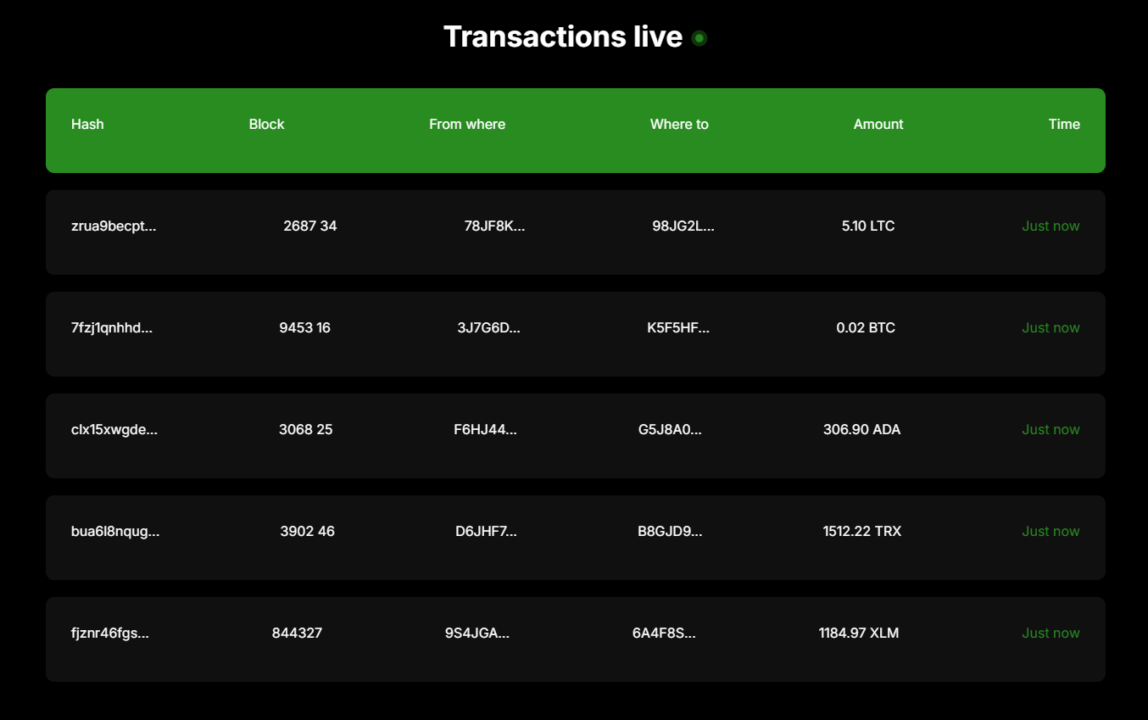

Kogza promotes trading, investment opportunities, liquidity pool participation, and automated trading through a robot. None of these features are substantiated with verifiable data. There is no transparent list of trading pairs, no clear information on fees or spreads, no documentation of liquidity sources, and no public evidence of how the trading robot operates. Users are expected to trust marketing claims without any proof.

Account Registration and Verification

The platform allows registration without mandatory identity verification (KYC). Users can create multiple accounts with minimal oversight. This approach violates standard compliance practices and increases the risk of arbitrary account blocks, withdrawal restrictions, and misuse of funds. The lack of proper verification is a significant indicator of operational risk.

Fund Security

Kogza claims to offer built-in wallets and basic security measures such as two-factor authentication. There is no evidence of cold storage, segregation of client assets, audits, or proof of reserves. Users cannot confirm whether their funds are actually held on-chain or merely reflected internally. This opacity creates substantial financial risk.

Withdrawal Issues

The primary concern with Kogza is withdrawals. Reports indicate delays, unexplained denials, demands for additional payments, and sudden account restrictions. There is no publicly disclosed withdrawal policy, no guaranteed processing times, and no transparent fee structure. Access to funds is entirely dependent on platform administrators.

Customer Support

Customer support is limited and largely ineffective. Users report slow responses, generic messages, or no reply at all, particularly regarding withdrawal issues. Reliable exchanges maintain support to resolve critical issues. Kogza’s lack of effective support highlights its disregard for user protection.

Reputation and User Reports

Independent reviews and user feedback consistently report the same issues: blocked accounts, unprocessed withdrawals, poor support, and unfulfilled promises. The systematic nature of these reports indicates that problems are inherent to the platform’s operation rather than isolated incidents.

Technical and Operational Red Flags

Analysis of the domain, operational history, and available documentation reveals additional warning signs: hidden registration data, minimal public information, lack of transparency about infrastructure, and overall secrecy. These traits are characteristic of short-term or fraudulent platforms.

Conclusion

Kogza does not meet the standards of a legitimate cryptocurrency exchange. Lack of regulation, opaque ownership, unverified functional claims, and repeated negative user experiences point to high financial risk. The platform is unreliable for trading, investing, or storing cryptocurrencies. Users should avoid Kogza entirely and prioritize licensed, transparent, and verified exchanges.