Pixocero Broker Review & Information 2025

Pixocero, operating via pixocero.pro and pixocero.online, promotes itself as an international broker offering access to global markets, innovative tools, and expert analysis. At first glance, the website presents an image of legitimacy — regulatory badges, promises of high returns, and a professional-looking team. However, upon closer investigation, Pixocero reveals every characteristic of a scam broker: fake licensing claims, offshore registration, manipulated trading software, and numerous complaints from clients unable to withdraw funds.

Regulation and Licensing

-

False claims of regulation: Pixocero advertises a CySEC license (№43211), which does not exist in the official Cyprus Securities and Exchange Commission registry.

-

Offshore registration: Domains are registered under OffshoreProxy LLC in Saint Vincent and the Grenadines — a known haven for unregulated brokers.

-

Regulatory action: On August 5, 2025, the Central Bank of Russia officially blacklisted Pixocero, identifying signs of a financial pyramid scheme.

-

No listing in global registers: Pixocero does not appear in the FCA (UK), ASIC (Australia), or AMF (France) databases.

In short: Pixocero operates without valid licenses and offers no legal protection for clients.

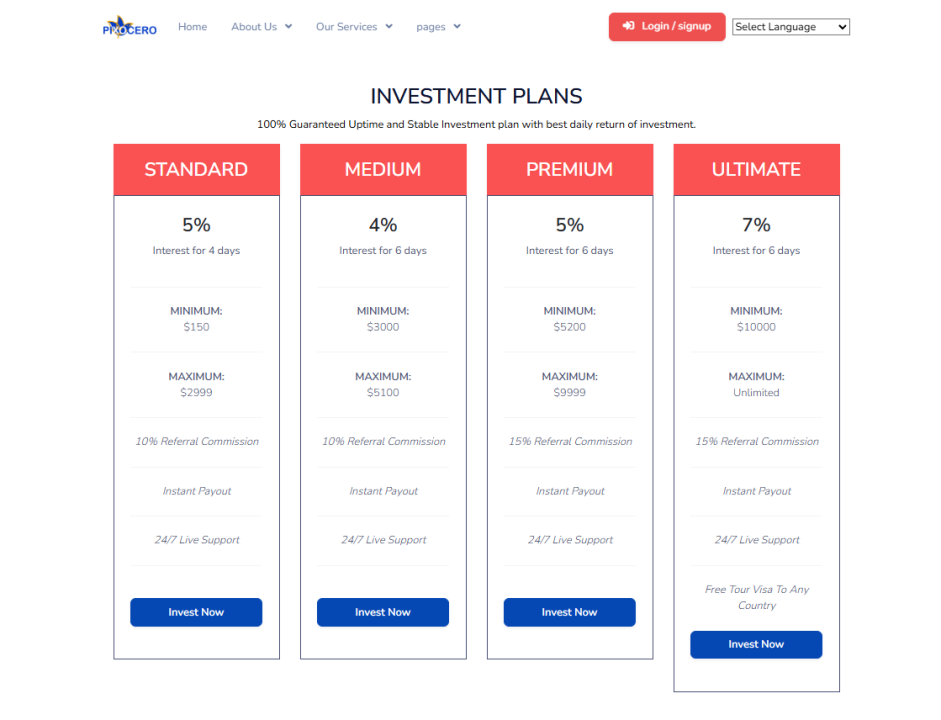

Account Types and Conditions

Pixocero advertises several account categories, often labeled as Standard, Premium, or VIP. However, details are vague:

-

No transparent specifications on spreads, commissions, or margin requirements.

-

Minimum deposits are initially low, but clients report aggressive pressure to upgrade to higher balances.

-

VIP accounts are promoted as offering “exclusive signals” or “personal managers,” but without documented conditions.

Commissions and Fees

One of the most common complaints about Pixocero is hidden fees:

-

Withdrawal requires upfront payments disguised as “taxes,” “insurance,” or “account unlocking fees,” sometimes as high as 35–90% of the withdrawal amount.

-

Clients are asked for income documentation for up to 8 years, an unrealistic requirement designed to block withdrawals.

-

Platform execution delays and manipulated spreads lead to consistent losses.

Trading Instruments

Pixocero advertises access to global markets, including:

-

Forex (major and minor pairs)

-

Commodities (gold, oil, silver)

-

Indices (NASDAQ, S&P 500, Dow Jones)

-

Cryptocurrencies

However, there is no evidence that trades are executed on real markets. Reported anomalies include:

-

Prices moving against global benchmarks (e.g., oil “dropping 6% every night” on Pixocero while remaining stable elsewhere).

-

Stop-loss orders failing to trigger, leading to larger-than-expected losses.

Trading Platform

-

Pixocero uses a closed web platform, fully controlled by the broker.

-

No access to MetaTrader 4/5 or cTrader, the industry standards.

-

Quotes, charts, and executions can be manipulated at will.

-

Clients report “technical errors” during profitable trades and especially when attempting withdrawals.

Customer Experiences

-

Andrey (lost $14,000): Blocked after being asked for 13 years of income documentation.

-

Julia (lost $820): Auto-trading wiped her account in 20 minutes, then demanded an “unlock fee.”

-

Maxim (lost 85% of deposit): Observed unrealistic oil price drops only on Pixocero.

-

Sergey (lost $8,700): Promised 200% returns, but his account was blocked after a week.

All stories follow the same pattern: initial trust-building, pressure for more deposits, then systematic blocking of withdrawals.

Pros and Cons

Pros (from the company’s marketing):

-

Attractive website design.

-

Promises of access to global markets.

-

Multiple account “tiers” for different investors.

Cons (in reality):

-

No real regulation or licenses.

-

Offshore registration with hidden ownership.

-

Proprietary platform prone to manipulation.

-

Withdrawal blocked by fake “fees” and documentation demands.

-

Officially blacklisted by the Central Bank of Russia.

-

Numerous consistent client complaints of lost funds.

Conclusion

Pixocero is a fraudulent operation, not a legitimate broker. From false regulation claims and manipulated trading platforms to fabricated fees and regulatory blacklisting, all evidence confirms that Pixocero exists solely to extract deposits from clients.

Investors should avoid Pixocero at all costs. Those already affected should stop further communication, collect evidence, and pursue chargebacks and legal action.

Classic scam setup. They feed you with bonuses and then block your account.

Andrew Carter

28.08.2025

ReplySupport is friendly until you stop depositing. Then they vanish.

Valdovskiy

17.08.2025

ReplyOne of the worst scams I’ve seen. Slick marketing, zero honesty.

Raimer

16.08.2025

ReplyThey pretended to be professional advisors but all they did was pressure me to invest more.

Nester

12.08.2025

ReplyDon’t trust Pixocero. I lost my savings here and never saw a single withdrawal.

Lexway

05.08.2025

Reply