StarTrader Broker Review

StarTrader is a multi-jurisdictional broker that provides access to forex and CFD trading. It started operating in 2017 and has since expanded its services to various international markets. The company offers trading in multiple asset classes and promotes itself as a global liquidity provider with local client support.

Despite the international branding, the company operates through a collection of regional and offshore entities. This makes it important to understand under which legal entity a client is registered and what regulatory framework applies.

Licensing and Regulation

According to publicly available information, StarTrader claims to operate under multiple licenses. These include registrations with:

- ASIC (Australia)

- FCA (United Kingdom)

- FSCA (South Africa)

- FSA (Seychelles)

- FSC (Mauritius)

- SCA (United Arab Emirates – limited license)

- A non-regulated entity in Saint Vincent and the Grenadines

Most global users are reportedly onboarded through offshore subsidiaries such as the one based in Saint Vincent and the Grenadines. This jurisdiction does not regulate online forex or CFD trading, meaning that clients under this entity are not afforded investor protections typical in more strictly regulated markets.

In 2023, the Spanish regulator CNMV issued a warning indicating that StarTrader was offering services in Spain without a proper license. This raises concerns about compliance in the European Union and similar jurisdictions.

Legal Structure

StarTrader is a group of affiliated companies operating under a shared brand. However, there is little publicly disclosed information about the ownership or senior management of the group. The broker’s internal structure appears decentralized, with different legal entities assigned to different geographic and operational functions.

This lack of transparency can complicate customer rights, especially when disputes involve multiple jurisdictions. Clients should be aware that the protections offered may vary significantly depending on the entity through which the account is opened.

Trading Platforms and Instruments

The broker provides access to two mainstream platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely used in the trading industry and support features like algorithmic trading, technical indicators, and multi-device access.

Clients can trade the following instruments:

- Currency pairs

- Global stock indices

- Commodity CFDs

- Cryptocurrencies

- Shares via CFDs

In addition to standard trading, StarTrader promotes a social trading service where clients can copy the strategies of other traders within the platform’s ecosystem.

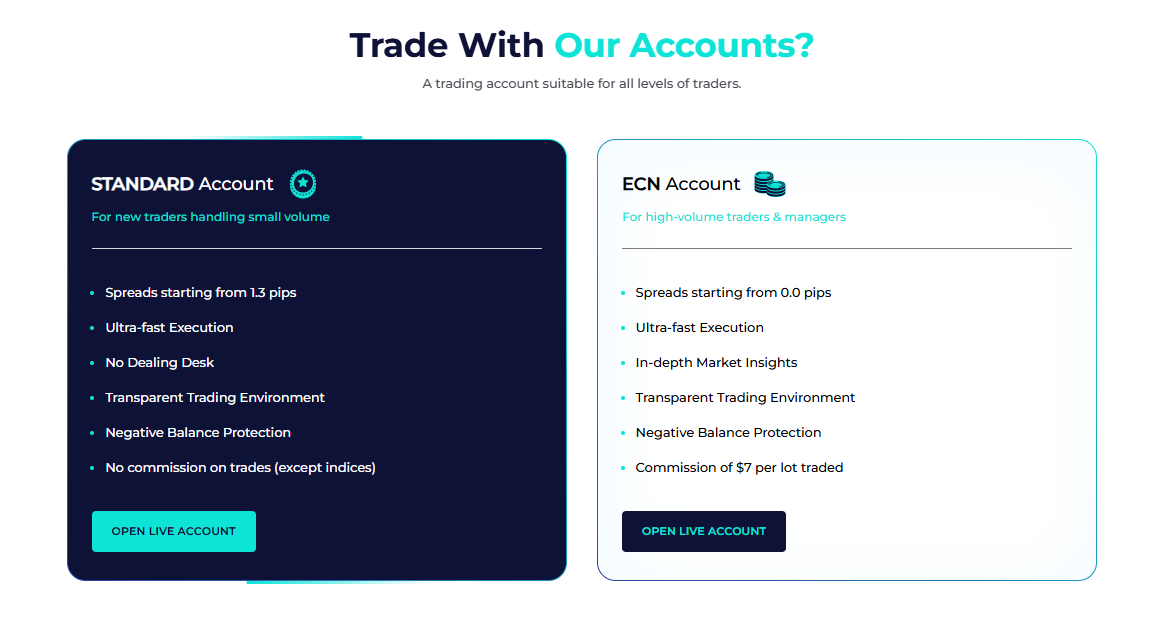

Account Options and Trading Terms

StarTrader offers several account types designed for different trading styles and volumes. Conditions may vary based on the selected entity and account configuration. General terms include:

- Minimum deposit from $50

- Leverage up to 1:500

- Spreads from 0.0 pips on ECN accounts

- Commission charges apply on certain accounts

- No stated deposit or withdrawal fees

- Support for payments via bank wire, credit/debit cards, and cryptocurrencies

The broker positions itself as a low-cost trading provider, but actual execution quality and cost transparency may depend on the specific entity and platform conditions.

Issues and Complaints

Numerous client complaints have been reported regarding fund withdrawals, profit cancellation, and account suspensions. Key concerns include:

- Delayed or denied withdrawal requests

- Removal of earned profits after trade execution

- Accounts closed or restricted without prior notice

- Lack of clear communication from support staff

- Balance deductions not reflected in transaction history

Several users report that their accounts were flagged for rule violations after generating profits, resulting in partial or full confiscation of earnings. In some cases, explanations were vague, and no supporting documentation was provided.

The broker has also been criticized for unresponsive customer service during dispute resolution, especially in cases involving fund recovery or technical issues.

Online Feedback

StarTrader’s reputation is mixed. Some users report smooth trading conditions, fast order execution, and helpful onboarding experiences. However, a significant number of reviews point to unresolved financial issues, lack of transparency, and inconsistent support.

On platforms like Trustpilot, the broker receives both positive and sharply negative reviews. The high volume of 1-star ratings typically centers on issues with withdrawals, lost funds, or unaddressed support tickets.

Financial risk monitoring sites have also flagged the broker as high-risk due to its offshore operations and lack of clarity around regulatory scope in certain markets.

Domain Clones and Brand Abuse

Several websites have emerged imitating the StarTrader brand, often using similar domain names and interfaces. These unauthorized sites may attempt to collect deposits or personal data by pretending to be affiliated with the official broker.

StarTrader has acknowledged these clones and issued public notices listing fake domains. The company states that its only official website is startrader.com. Nonetheless, the presence of these clones increases the risk of client confusion and fraud.

Conclusion on broker

StarTrader operates as a global broker with multiple registrations and a wide trading offering. While it holds licenses in several regions, many of its users are routed through offshore structures that lack regulatory oversight.

Clients considering StarTrader should evaluate:

- Which legal entity will manage their account

- Whether investor protections apply in their jurisdiction

- How the broker has handled complaints related to fund access and account control

- The transparency of fees, terms, and trade execution

StarTrader may suit experienced traders who understand offshore brokerage environments and are comfortable managing associated risks. For those seeking strong legal protection and regulator-backed dispute resolution, alternative brokers under stricter oversight may be more appropriate.