Tag Markets Broker Review

Tag Markets presents itself as a global brokerage offering trading in cryptocurrencies, forex, stocks, metals, and CFDs. The company promotes copy trading, managed accounts, personal account managers, and VIP programs. Marketing materials promise 24/7 support, fast trade execution, and compliance with financial regulations. On the surface, the platform appears professional. However, a detailed investigation reveals multiple factors that raise serious concerns about the broker’s legitimacy and the safety of client funds.

Regulation and Licensing

Tag Markets does not hold a valid license from any recognized financial authority. The broker is not registered with FCA, CySEC, ASIC, SEC, or any other reputable regulatory body. The license number it references previously belonged to another entity and has been terminated. Using this expired license creates a false sense of security and misleads clients. Operating without proper regulation exposes clients to full financial risk, without access to legal recourse, investor compensation, or regulatory protection.

Legal Structure and Ownership

The company operates through offshore jurisdictions with minimal oversight. Ownership information, management details, and ultimate beneficial owners are not disclosed. There are no audited financial statements, no confirmation of capital adequacy, and no proof of segregated client accounts. Contact information is limited to email and online forms, which fails to meet the standards of legitimate brokerage firms. This level of opacity makes client funds highly vulnerable.

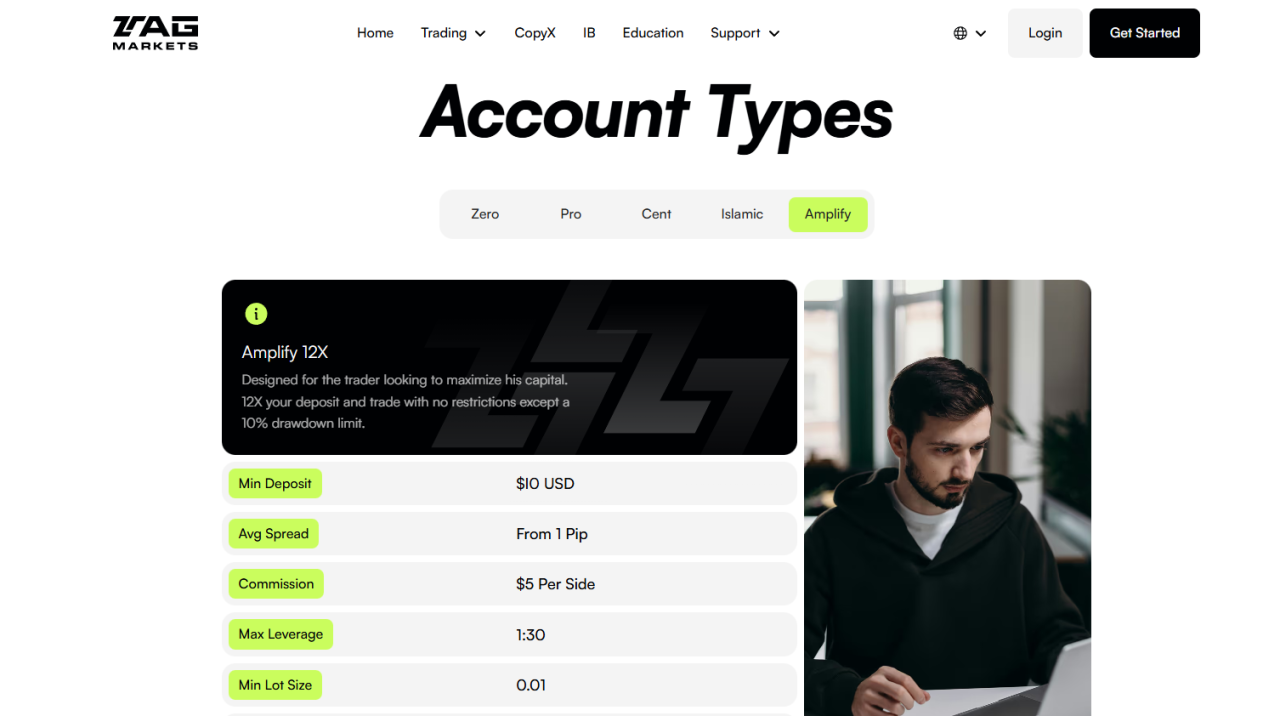

Trading Platform and Execution

Tag Markets provides access to MetaTrader and its own proprietary platform, promising fast execution and real-time pricing. Critical details such as order execution type, liquidity providers, spreads, and trading commissions are not disclosed. User reports indicate delayed execution, abnormal spreads, and unstable price behavior during high volatility. Lack of transparency makes it impossible for traders to assess the fairness of execution or measure true costs of trading.

Copy Trading and Managed Accounts

Copy trading and managed accounts are heavily promoted as safe and profitable options. Tag Markets does not disclose who manages client funds, whether these managers are licensed, or how performance is verified. Agreements governing these services are either absent or non-binding. Clients effectively hand over funds to anonymous managers without protection or accountability, creating extremely high risk.

VIP Programs and Account Managers

VIP programs and personal managers are designed to encourage larger deposits. Clients are often subjected to aggressive sales tactics, pressure to deposit more money, and promises of higher returns. Once substantial deposits are made, responsiveness declines and responsibility for issues shifts to the client. These practices indicate that marketing priorities outweigh client protection.

Deposits and Withdrawals

Tag Markets claims to offer multiple deposit and withdrawal options including bank cards, cryptocurrencies, wire transfers, and e-wallets. Fees and processing times are vague and described as flexible. In practice, clients report delays, additional verification requests, unexpected restrictions, and refusals to release funds. Withdrawal problems typically arise when attempting to access profits or large amounts, with frequent account blocks and unresponsive support.

Client Feedback

Analysis of client reviews reveals consistent patterns. Initial registration and deposits proceed smoothly, but withdrawal attempts frequently encounter obstacles. Positive reviews mainly focus on platform interface or early interactions with managers, while successful fund withdrawals are rarely reported. Negative feedback consistently highlights blocked accounts, ignored inquiries, and arbitrary changes to account terms.

Marketing and Education

Tag Markets invests heavily in educational resources, videos, and market analysis to create an impression of professionalism. These materials serve primarily as marketing tools to attract deposits and build trust. They do not compensate for the lack of regulatory oversight, legal transparency, or protection of client funds.

Conclusion

Tag Markets is an unregulated offshore broker with misleading licensing claims, opaque ownership, and repeated reports of withdrawal issues. Trading conditions are unclear, client protection is absent, and accountability is minimal. The broker prioritizes marketing and deposit collection over transparency or safety. Engaging with Tag Markets carries a high risk of total loss. Only fully licensed, transparent, and regulated brokers should be considered for trading or investment. Tag Markets fails fundamental standards of reliability and poses significant risk to clients.